The welfare cost of inflation revisited: The role of financial innovation and household heterogeneity

Abstract

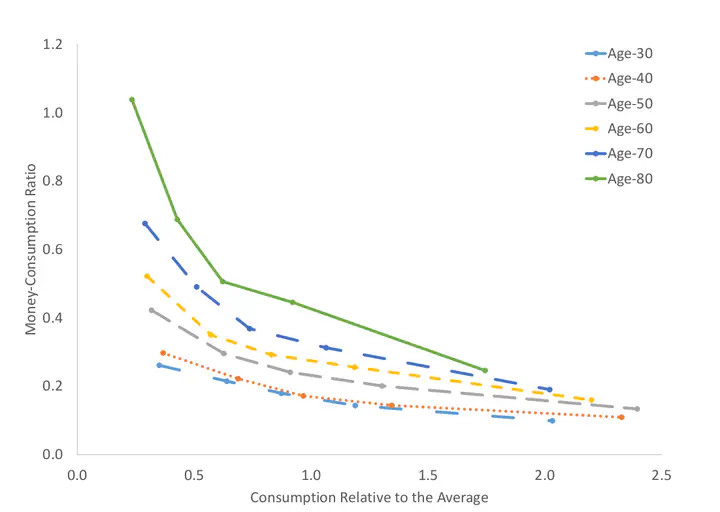

The money-consumption ratio increases with age and decreases with consumption, and the recent era of low interest rates has seen a large increase in the aggregate money-consumption ratio. We estimate an overlapping generations model with money for transaction purposes for the age effects and the extent of financial innovation using aggregate and household-level money holdings. We then assess the welfare cost of a 3 percentage point increase in inflation, incorporating the cost from the redistribution of non-money nominal wealth. We find that the welfare costs are 13% of one-year consumption and are borne mostly by the poor and the old.

Type

Publication

Journal of Monetary Economics, 118, 366-380